XRP Price Prediction: Can Whales and Regulatory Clarity Push It to $15?

#XRP

- Technical Strength: XRP trades above 20-day MA with Bollinger Band breakout potential.

- Whale Activity: $3.8B accumulation signals strong institutional interest.

- Regulatory Tailwinds: SEC settlement and fundraising waiver reduce legal overhang.

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge

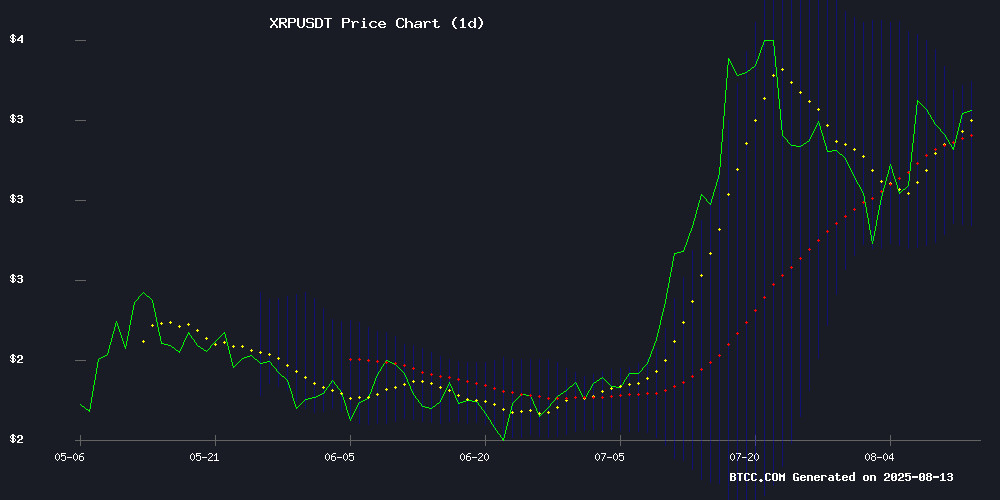

According to BTCC financial analyst Olivia, XRP is currently trading at 3.22700000 USDT, above its 20-day moving average of 3.1132, indicating a bullish trend. The MACD (12,26,9) shows a slight bearish crossover at -0.0159, but the price remains within the Bollinger Bands (Upper: 3.3830, Middle: 3.1132, Lower: 2.8434), suggesting potential upward momentum if it breaks the upper band.

XRP Market Sentiment: Whales and Regulatory Wins Fuel Optimism

BTCC financial analyst Olivia notes that XRP's market sentiment is mixed but leans bullish. Whale accumulation of $3.8 billion and Ripple's SEC victory are positive catalysts, though concerns about a 45% crash risk and lost support at $3.40 temper excitement. Key headlines like VivoPower's $100M Ripple bet and a $12.60 price target highlight long-term optimism.

Factors Influencing XRP’s Price

XRP Whales’ $3.8 Billion Accumulation May Drive Price to All-Time High

XRP's potential rally to an all-time high gains traction as whales accumulate $3.8 billion worth of the token in just four days. Despite over 95% of circulating supply currently in profit—a traditional marker for a market top—XRP has historically defied such reversals, maintaining upward momentum.

Whale activity underscores growing institutional confidence, with addresses holding 100 million to 1 billion XRP adding 1.2 billion tokens during a recent price dip. This accumulation suggests strategic positioning for future gains, potentially fueling FOMO among retail investors.

Santiment data reveals XRP's unique resilience against typical profit-taking cycles. The token's macro momentum now hinges on whether whale demand can offset broader market headwinds, setting the stage for a potential breakout.

XRP Faces 45% Crash Risk Despite Post-SEC Rally Optimism

XRP's legal victory against the U.S. Securities and Exchange Commission (SEC) initially sparked institutional optimism, with daily trading volumes surging 208% to $12.4 billion. Analysts now estimate a 95% chance of a spot XRP ETF approval by October 2025.

However, the rally shows signs of fatigue. XRP dipped 4% to $3.13 after hitting an intraday peak of $3.32, with heavy selling pressure suggesting profit-taking by large holders. Resistance remains firm at $3.27–$3.32, while support holds at $3.12.

Technical analysts warn of a bearish divergence on XRP’s two-week chart, mirroring the 2017–2018 market peak that preceded a prolonged selloff. If the pattern repeats, XRP could slide 45% toward $1.64, with interim support NEAR $1.90–$2.00. While this correction may not end the broader bull market, it could shake out overleveraged positions.

Top Performing Cryptos for 2025: Cold Wallet, HYPE, TAO, and XRP in Focus

Utility and infrastructure are reclaiming the spotlight in crypto, shifting attention toward projects with real-world impact. Cold Wallet ($CWT) leads the charge with a $270 million acquisition of Plus Wallet, consolidating over 2 million active users. Its presale, now at Stage 17 priced at $0.00998, promises a 3,632% ROI potential at launch, having already raised $5.9 million from 706 million tokens sold.

Hyperliquid stakes its claim with an exchange-first approach, while Bittensor advances decentralized AI networks. XRP resurges amid regulatory progress and institutional partnerships. These projects exemplify the market's pivot toward sustainable growth over speculative hype.

Ripple’s XRP Faces Competition in SWIFT Replacement Ambitions

Ripple’s longstanding ambition to disrupt SWIFT’s dominance in cross-border payments faces a reality check as industry dynamics shift. CEO Brad Garlinghouse has targeted a 14% share of the $5 trillion daily transaction market, leveraging XRP’s near-instant settlement capabilities. Yet the narrative overlooks SWIFT’s own blockchain evolution.

Chainlink’s Zach Rynes highlights SWIFT’s strategic pivot through its integration with blockchain infrastructure. The network now connects 11,500 member banks to public and private chains via Chainlink, enabling tokenized asset flows without dismantling its legacy system. This adaptation challenges the notion of any single cryptocurrency displacing the incumbent.

The development underscores a broader trend of traditional finance co-opting blockchain efficiencies rather than being replaced by them. While XRP remains a liquidity tool in Ripple’s solutions, SWIFT’s hybrid approach demonstrates institutional adoption pathways that may favor interoperability over disruption.

SEC Grants Ripple Waiver to Ease Fundraising Restrictions Amid Legal Settlement

Ripple Labs secured a regulatory victory as the U.S. Securities and Exchange Commission (SEC) issued a special waiver allowing the blockchain firm to raise private capital under Regulation D. The decision follows the dismissal of appeals tied to a 2023 court injunction that had barred Ripple from using the exemption due to past securities violations.

The waiver, justified by "good cause," enables Ripple to sell XRP to accredited investors—a critical lifeline for operations and expansion. Former SEC attorney Marc Fagel noted the move's audacity, as it effectively countermands the district court's earlier restrictions. While the ruling doesn’t absolve prior infractions, it marks a pivotal shift in Ripple’s ability to navigate capital markets.

XRP Faces Further Downside After Losing Key $3.40 Support

XRP has breached its crucial support level at $3.40, triggering a swift descent toward the $2.50 region. The rejection at this resistance zone underscores shifting market sentiment, with analyst Michael van de Poppe warning of potential short-term losses.

Technical indicators reflect growing pressure. The token's daily RSI at 53 suggests neutral momentum, but the failure to hold above $3.40 has shifted focus to lower support levels between $2.40-$2.60. Traders now watch for either a rebound above $3.40 or consolidation near $2.50 as potential entry points.

Market volatility remains elevated, with the $2.60 level emerging as a critical threshold to prevent further downside. The speed of this correction demonstrates how quickly crypto markets can reverse course after key technical levels break.

Whales Accumulate XRP Amid Escrow Unlock FUD, Market Stability Maintained

Ripple's recent $3.28 billion XRP escrow unlock triggered transient bearish sentiment, but analysts emphasize the mechanism's long-term role in stabilizing markets. The released tokens were swiftly returned to escrow, invalidating fears of a supply dump.

Legal expert Bill Morgan underscored CEO Brad Garlinghouse's 2017 rationale for escrow locks—supply predictability and market trust. Whale accumulation suggests institutional confidence persists despite retail traders' knee-jerk reactions to the procedural unlock.

XRP Breaks 7-Year Technical Trend – Eying $12.60 Price Target

XRP has shattered a seven-year symmetrical triangle pattern, signaling a potential bullish surge toward $12.60. The breakout, first observed in November 2024, marks a dramatic departure from years of consolidation.

Technical analysts highlight the significance of this prolonged pattern—the longer the triangle, the more explosive the breakout. XRP's price catapulted from the $0.60-$0.70 range in late 2024 to a new consolidation level of $3.18 by August 2025.

This structural shift suggests a fundamental revaluation of one of crypto's most enduring assets. Market participants now watch for sustained momentum to validate the $12.60 projection.

VivoPower's $100M Ripple Bet Fuels Speculation of XRP Price Surge to $15

VivoPower International has made history as the first U.S.-listed company to acquire Ripple shares, with a $100 million investment that translates to roughly 211 million XRP at current valuations. This institutional endorsement is sparking renewed bullish sentiment around XRP, particularly as technical charts show the cryptocurrency testing key breakout levels.

Analysts highlight the significance of conservative investors gaining exposure to XRP through traditional equity channels. The MOVE coincides with strengthening technical indicators across multiple timeframes, suggesting potential for a decisive upward move if XRP breaks its current consolidation pattern.

Ripple Secures Landmark Victory Over SEC, XRP Price Surges 8% Amid Regulatory Clarity

Ripple's protracted legal battle with the U.S. Securities and Exchange Commission has reached a decisive conclusion. The SEC formally dismissed its case on August 12, 2025, following a joint stipulation of dismissal filed August 7. This resolution removes a five-year overhang on XRP, triggering an immediate 8% price surge as markets digest the implications.

SEC Chair Paul Atkins framed the outcome as a pivot point for regulatory strategy, stating the agency will now shift focus from litigation to policy formulation. The development coincides with advancing legislation - the CLARITY Act - which establishes clear jurisdictional boundaries between the CFTC and SEC for crypto assets. Decentralized blockchains like XRP WOULD fall under commodity classification.

Market participants interpret these developments as removing critical barriers for institutional adoption. The TRUMP administration's pro-crypto executive orders and legislative progress have created a favorable macro-regulatory environment. XRP's technical outlook appears bullish, with the altcoin breaking key resistance levels as traders price in improved fundamentals.

XRP Traders Watch Key Support Levels Amid Market Pullback

XRP faces a critical test at the $3 support level as the broader cryptocurrency market retraces 1.78% from recent highs. The digital asset has retreated 7% from its $3.40 peak, leaving traders debating whether this represents a buying opportunity or the start of a deeper correction.

Technical charts show XRP carving lower highs since its mid-July surge to $3.60, with the $2.95 level now emerging as a potential safety net. Market observers note that prolonged consolidation often precedes significant breakouts, making the current price action particularly consequential.

On-chain metrics will prove decisive in determining whether this pullback constitutes a healthy market reset or the beginning of sustained weakness. A hold above key support levels coupled with stable network fundamentals could reignite bullish momentum, while breakdowns in either domain may trigger further position unwinding.

How High Will XRP Price Go?

Olivia from BTCC suggests XRP could rally toward $12.60–$15 if it sustains above the 20-day MA (3.1132) and breaks the Bollinger upper band (3.3830). However, losing the $3.40 support may trigger a 45% correction. Key factors include:

| Factor | Impact |

|---|---|

| Whale Accumulation | Bullish (Demand surge) |

| SEC Resolution | Bullish (Regulatory clarity) |

| Bollinger Breakout | Bullish (Technical confirmation) |

| $3.40 Support Loss | Bearish (Short-term risk) |

3.22700000 USDT

3.1132

3.3830

$3.40